A Week in the Future 1

Data centers, AI talent wars, age verification, and sports-entertainment.

Introducing A Week in the Future

Welcome to A Week in the Future. In these posts, I’ll examine recent news events and use them to extrapolate future trends. Some predictions may not be entirely serious, but there should always be a kernel of truth to latch onto.

Why me? I once forecast (energy) markets for a living, and I’ve written several speculative fiction novels—eminent qualifications these days. I hope subscribers come to enjoy these musings on the future. As the Chinese proverb goes, we are cursed to live in interesting times, and I’ve a feeling I won’t be short of material.

So, without further ado, let’s begin.

I: Hyperscalers are the new Oil Companies

Hyperscalers—also known as Cloud Service Providers (CSPs)—are spending mind-boggling sums on AI-focused data center buildouts. In January, Microsoft announced it would spend $80 billion in 2025, most of it on cloud infrastructure. Meta expects 2025 CapEx in the $66–72 billion range, up $30 billion from last year. Unlike Microsoft, Meta’s infrastructure is for internal use only; it takes a lot of compute to build a superintelligence.

For comparison, ExxonMobil—the largest US-based energy major—will spend $27–29 billion on CapEx in 2025. This is a company that builds some of the most expensive infrastructure on the planet: offshore oil platforms, LNG plants, refineries. Each day, it produces around 4.3 million barrels of oil equivalent.

As recently as 2013, ExxonMobil was the most valuable company in the world, with peers Shell and Chevron not far behind. Back then, Nvidia—the maker of the specialised chips that power modern AI—was worth around $9 billion. Fast forward to 2025 and Nvidia is the world’s most valuable company, valued at a staggering $4.46 trillion.

Historically, tech has been far more profitable than oil. Whereas a 30% gross margin is considered good in oil, companies like Meta regularly post margins above 80%. But as hyperscalers move into costly infrastructure, those stellar margins may erode.

Hyperscaler spending is likely to increase in the coming years. Next-generation AI facilities could draw 1,000 megawatts (1 gigawatt) of power each, ten times the capacity of today’s largest.

A 1 GW data center might cost $10 billion for the “powered shell” alone—buildings, cooling, backup power, batteries, transformers—and another $20 billion to deck the server racks with GPU-based accelerators.

When British mathematician Chris Humby said in 2006 that “data is the new oil,” he couldn’t have known how right he’d be. Data and energy have never been so closely aligned. Power generation is rapidly becoming the hyperscalers’ top concern. They need constant “baseload” power for their mega-centers, but utilities are struggling to keep up.

Some hyperscalers are even considering building their own behind-the-meter (BTM) generation—plants located next to their data centers and dedicated almost entirely to powering them. At that point, they’d effectively be both tech giants and utilities. And as their CFOs will note, the utilities business is even less profitable than oil.

II: The AI Transfer Window is Always Open

Recently, AI researchers have been compared to pro athletes. Youthful, scarce in number, highly paid. Signing a top performer can propel an also-ran corporation—read middling team—to the top of the pile. Think Joe Montana being drafted by the 49ers in 1979, or Cristiano Ronaldo’s move to Real Madrid in 2009.

The numbers certainly scan. Sam Altman, OpenAI’s CEO, claims Meta offered some of his researchers over $100 million to jump ship. When one rejected such an offer, Mark Zuckerberg reportedly came back with $250 million over four years plus a $100 million signing bonus. There are even rumours of a $1.5 billion offer being turned down. Nice work if you can get it.

For comparison, Steph Curry—a highly regarded basketball player, I’m told—earns about $50 million a year from the Golden State Warriors. Meanwhile, Patrick Mahomes, a talented practitioner of the American variety of football, is on a 10-year deal worth $450 million. Ronaldo, now in the twilight of his career, earns a cool $211 million a year in Saudi Arabia.

Athletes also rake in endorsements. Mr. Curry reportedly nets another $100 million annually from brands like Under Armour, 2K Sports, JPMorganChase, and that paragon of healthy living, Subway. Light-deprived computer scientists aren’t typically as marketable as athletes in peak physical condition. At the same time, they often negotiate equity in the already valuable companies they join—a perk rarely afforded to sports stars.

What makes these AI researchers so valuable? Think back to those hyperscaler data centers. A top AI researcher might grok a way to train the next frontier model using five 100 MW centers instead of a single 1,000 MW mega-center—saving millions in power costs alone. Or they might spot the next PR disaster before it hits: think Google’s ethnically diverse Nazi stormtroopers or one of Grok’s more colourful outbursts.

Looking at the way players move between teams, the analogy weakens. Most American sports use a draft system where struggling teams get their pick of the most promising college athletes—a vaguely socialist setup to keep leagues competitive. Corporate America has no such mechanism. It would be like Apple being forced to gift Jony Ive and Tim Cook to BlackBerry in 2008, a year after the iPhone launch.

American sports also feature player trades, free agency whereby a player can move after their contract runs down, and other tactics like trading future draft picks. In the AI talent wars, tech leaders like Zuck are actively “poaching” researchers employed by competing firms. This kind of move is possible in (European) football, where a player with an active contract can be extricated via the payment of a transfer fee.

These fees can be astronomical. Kylian Mbappé, arguably the world’s best player, is a good case in point. Back in 2018, Mbappé moved from Monaco to PSG for around $210 million, a then world record fee. 6 years later, Mbappé moved from PSG to Real Madrid, football’s Apple, for the grand sum of zero dollars. This “free transfer” was only possible because Mbappé had let his contract with PSG run down. Don’t worry though. Mbappé still gets a $165 million signing bonus spread over five years.

Both of these mega deals would have been negotiated by Mbappé’s agent. FIFA, football’s governing body, caps an agent’s fee at 10% of the gross transfer fee. Not too shabby on a $210 million transfer. Despite the vast sums involved in tech, AI doesn’t yet appear to have such specialised agents. Some venture capitalists—VCs—may see themselves as natural intermediaries.

Bill Shankly, the legendary Liverpool manager, once opined that football was more important than life or death. In tech, the stakes are arguably higher. Beyond the multi-trillion-dollar market, many in the industry believe they’re building humanity’s successor. Those true believers are exactly the kind of players Zuck wants on his team.

III: Age Gates of Hell

Here in the UK, the Online Safety Act has been making headlines. It’s the first attempt by a democratic nation to age-gate—or, as some would put it, “censor”—its domestic internet. The children’s safety provisions came into effect on July 25, and since then, internet companies operating in the UK have been scrambling to comply.

As a wholly random example, anyone attempting to stream tasteful content on Pornhub—the Walt Disney corporation of pornographers—was met with a warning demanding proof they were over 18.

“As to the evil which results from a censorship, it is impossible to measure it, for it is impossible to tell where it ends.” Jeremy Bentham, possibly referring to the example above

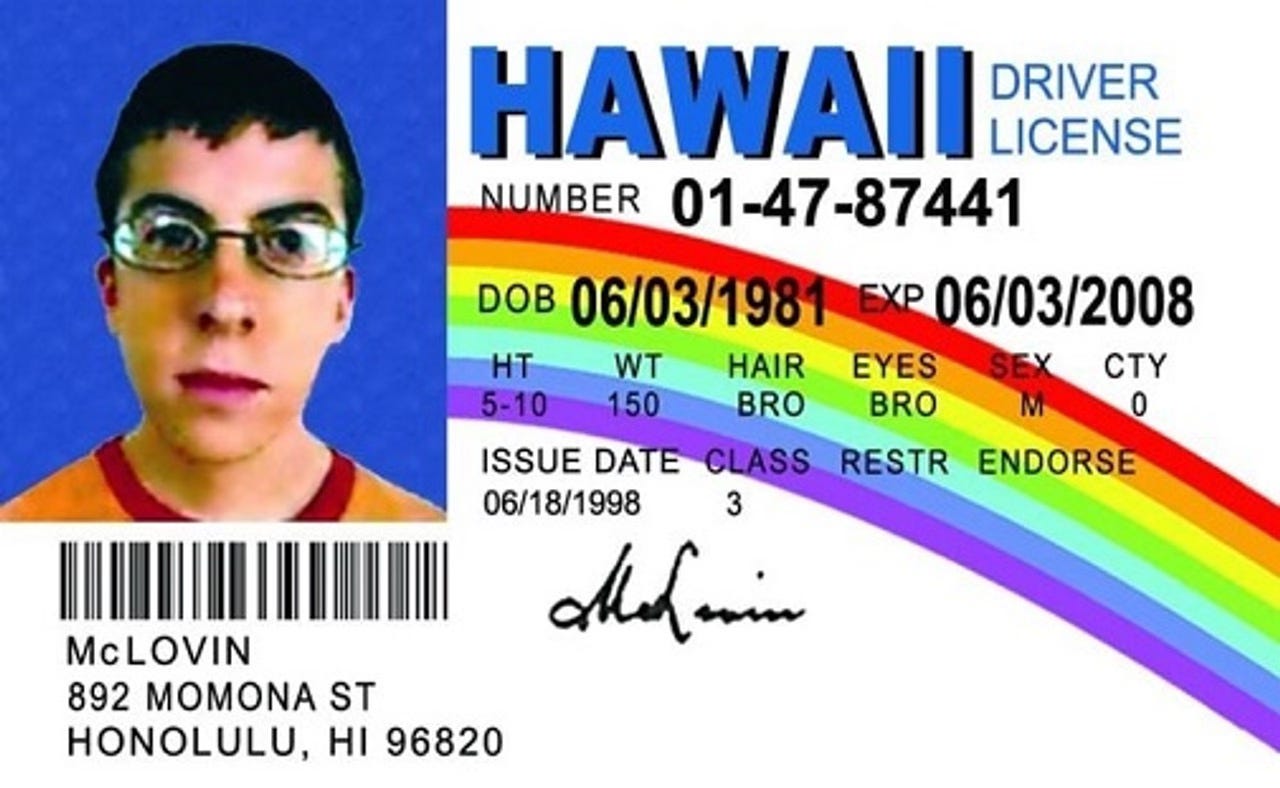

Naturally, there was no agreed standard for proof of identity, leading to a patchwork of solutions: uploading a scan of a UK passport or driver’s license; supplying credit card details (you must be over 18 to have one); even sending video of your face for algorithmic analysis. When users are being forced to send personal details to overseas porn sites, something has probably gone awry in the regulatory process.

Private companies are, of course, renowned for keeping their user’s data safe. Just think of the recent Tea dating app scandal, or closer to home, the data breach at Marks & Spencer, a UK-based retailer. Government agencies don’t have spotless records either, but at least they’re democratically accountable.

One workable option might have been a standardised ID card scheme. These are common across Europe—in France, Germany, Belgium, Spain—and other parts of the world. With a national ID number, citizens could verify their age without handing over sensitive info to a dozen different websites. For a number of reasons too dull to get into, ID cards have become a third rail issue in the UK, and no mainstream party wants to touch them.

Without such a scheme, the Online Safety Act looks even more absurd. Dreamed up by the previous centre-right Conservative government in response to a media panic over social-media content, the legislation was already losing momentum before the 2024 election. The Tories had slowed the rollout and might have shelved it altogether. Even the press, once enthusiastic, was turning against the bill, realising it could hurt online ad revenues.

Strangely, the incoming centre-left Labour government decided to push the Act through in full. Perhaps they believed a fight with big social media firms would play well with voters, especially parents of young children. If so, the backlash in the past couple of weeks will have been sobering. For now, the government seems determined to hold the line.

The longer-term consequence of the act may be the privatisation of age verification. Nimble start-ups are already rolling out commercial verification systems, and in time the big tech platforms will almost certainly move in. Apple looks best placed: it already holds detailed personal information for millions of iPhone users, and “verification services” could become a tidy new revenue stream—something Wall Street has been pushing for.

Meta, with its vast trove of user data, could do the same, though Zuck seems wary of the potential liabilities should user ages be misclassified. That hesitation may not last. Several US states have passed age-verification laws, and the US Supreme Court recently upheld a Texas statute despite intense lobbying from big tech. Once implemented in a major state like Texas, market reality will push the requirement nationwide.

None of this is to deny that a problem exists. Children shouldn’t be able to watch graphic content on phones and tablets any more than they should stroll into a cinema showing an 18-rated film. Like much bad regulation, the Online Safety Act is rooted in good intentions—chiefly, curbing harmful content on social platforms. It would be wonderfully ironic, and very British, if Meta turned out to be one of the biggest beneficiaries.

IV: The NFLCU

Turning to the back pages: Disney’s ESPN recently struck a blockbuster deal with the National Football League (NFL) to acquire the NFL Network and other media assets, in exchange for the league taking a 10% equity stake in the sports network. The deal, still pending regulatory approval, will provide premium content for ESPN’s upcoming streaming service.

Thus the mouse kingdom is now deeply entwined with America’s foremost sport—a match made in heaven, surely? In the fragmented attention economy, American football captures the attention like nothing else. In 2024, 72 of the 100 most-watched US TV broadcasts were NFL games. Even the college variety of football outpaces basketball and baseball in viewership.

Given that dominance, why so much talk about Disney spinning off ESPN in the future? There’s an obvious potential windfall—Bank of America valued ESPN at $24 billion in 2023—but why sever ties with the crown jewels of live entertainment? Disney calls itself “the world’s premier entertainment company,” and there’s no bigger (American) entertainment property than the NFL.

There are reasons why Disney is slightly cool on football. First, in contrast to IPs like Marvel and Star Wars, they can never own or fully control the NFL. The league is a trade association, not a public corporation, and even if it were for sale, the price—conservatively estimated at $163 billion— would put it out of reach for all but a handful of tech titans. Any such deal would also face ferocious regulatory scrutiny.

Second, the NFL cannot credibly call itself a global brand. The 2024 Super Bowl drew 127.7 million viewers in the US and another 60 million or so worldwide. In comparison, 1.5 billion people watched the 2022 World Cup Final, the showpiece event of the beautiful game. Basketball and baseball, football’s poor cousins in the states, have greater international reach.

Third, there’s the potential for scandal: player misconduct, from domestic violence to murder; cheating scandals; doping; unresolved liabilities over brain injuries. None of this sits comfortably with a family-friendly brand like Disney, though Hollywood has hardly set a great example in such matters.

“This game has got to be about more than winning. You’re part of something here... along the way, I want you to cherish it, because when it’s gone, it’s gone forever.” Tony D’Amato (Al Pacino), possibly referring to Disney selling ESPN.

Even so, it’s hard to imagine Disney walking away. For better or worse, it is America’s entertainment company, and the NFL is America’s most popular sport by far. The synergy is obvious. Disney has a knack for monetising dreams, whether it’s wielding a lightsaber or scoring a game-winning touchdown.

Why shouldn’t every NFL franchise have its own theme park? Imagine the media spin-offs: one-off films and live experiences using cutting-edge 3D projection; TV dramas and reality shows; an endless series of video games. Disney’s mission statement talks about “the power of unparalleled storytelling.” The NFL delivers new storylines every week. Surely it’s time for Disney to add its pixie dust.

The Sci-fi Strategist

13th August 2025